capital gains tax news canada

In Canada 50 of your capital gains are taxable. The average Canadian house price climbed at an annualized rate of 20 per cent hitting 816720 in February according to the Canadian Real Estate Association CREA.

How Is Capital Gains Tax Calculated On Real Estate In Canada Srj Chartered Accountants Professional Corporation

You must pay taxes on 50 of this gain at your marginal tax rate.

. The capital gains tax rate in Ontario for the highest income bracket is 2676. Canadas capital gains inclusion rate is 50. Canada Capital Gains Tax on Investment Properties.

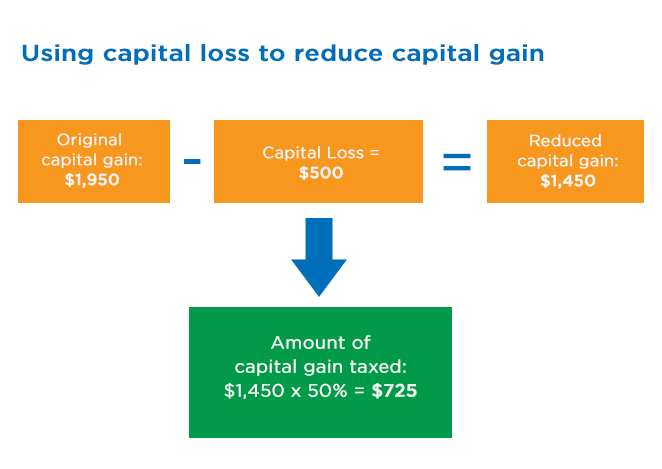

One tax-efficient strategy for individuals to realize capital gains is selling the securities to a new or existing Canadian holding company in exchange for shares with an equivalent fair market. When investors sell a capital property for more than they paid for it the Canada Revenue Agency CRA applies a tax on half 50 of the capital gain amount. As previously argued here at Finances of the Nation the current system is inequitable because capital gains income is unequally distributed.

Next lets compare how capital gains tax is applied to investment properties for the US. Yes there was. Canada Tax Capital Gains Tax Corporate Tax Income Tax.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to your income. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

You have to include all of your capital gains in your tax return which means that all of your capital gains are included in income. A capital gains deduction of 431692 two-thirds of a LCGE of 883384 applies to QSBCS gains in 2020In 2019 QSBCS can award an interest deduction of 433456 12 of a LCGE of 866912. Under the Canada Income Tax Act you only have to pay tax on 50 of the profits as capital gain tax to the CRA.

In Canada 50 of the value of any capital gains are taxable. The capital gain is not based on the value of the capital property but only on the adjusted cost base. Could an increase to say 67 as it was from 1988-89 or 75 as it was from 1990-1999 happen.

Red Flags For Tax Audits. The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in. Capital gains tax rates on most assets held for a year or less correspond to.

2 hours agoBut then the tax bill comes due. One of these ideas is a capital gains tax on home sales. An examination of the taxation of capital gains in Canada suggests that this objective would be better achieved with a reduction in the inclusion rate of capital gains The Chrétien and Martin Liberals reduced the capital gains inclusion rate the amount of capital gains subject to tax from 75 to 50 as part of a larger initiative to improve Canadas.

NDPs proto-platform calls for levying. So out of the 30000 profit you made from selling you would have to report 15000. In 1985 the government introduced a capital gains exemption where each Canadian did not have to pay any tax on capital gains up.

In this article we outline the history of capital gains taxation in Canada describe some of the key features of the current system and comment on potential reforms. For example on a capital gain of 10000 half of that or 5000 would be taxed based on the individuals tax bracket and the province of. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for Canadian-controlled private corporations and 24-27 percent for individuals at the highest marginal rate depending on the province.

2666 at the top combined capital gains rate of 5331 per cent and with the current inclusion rate of. Presently the capital gains inclusion rate for realized or deemed realized capital gains is 50. Canadian Capital Gains Tax of Investment Properties.

Capital Gains Tax Rate. Truth Tracker Richard. January 1 2022 marks the 50th anniversary of the capital gains tax in Canada.

How Much Capital Gains Is Tax Free In Canada. Conservative Leader Erin OToole is accusing the Liberals of planning to impose a capital gains tax on people who sell their homes but Justin Trudeau says its not true. But in Canada today only 50 per cent of realized capital gains are included in taxable income meaning the effective personal tax rate on these gains is only half that of other income.

There are many misconceptions about capital gains tax in Canada including the belief that all gains are taxed at a rate of 50. They taxed me on 50 of my earningscapital gains at a 2697 rate or roughly 135 on everything overall and im trying to figure out this have was normal or really high and what everyone is paying So if anyone else has any experience with cryptocurrency taxes in Canada and what percentages youve been taxed at before or for 2021 id really appreciate the help. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax.

Can Capital Gains Push Me Into A Higher Tax Bracket

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Capital Gains Tax Attribution Rules In Canada Versus The Us

Selling Stock How Capital Gains Are Taxed The Motley Fool

A 95 Year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

Crypto Taxation In Canada 2022 Ultimate Guide Ocryptocanada

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Crypto Tax The Ultimate 2022 Guide Koinly

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know

Reporting Capital Gains Dividend Income Is Complex Morningstar

Reporting Capital Gains Dividend Income Is Complex Morningstar